President Trump is a complete surprise to everybody because he is fundamentally unelectable. A vast majority of Americans dislike him. His favorability ratings never got above -9 in the past year while Clinton’s occasionally drifted into positive territory.

Hillary Clinton’s staff is claiming that the actions of FBI director Comey were the cause of Trump’s victory.

This is kinda sorta true.

It fails to recognize that Clinton’s defeat was the direct result of Trump’s abilities as one of the best brand managers in the country.

Doubt the description of Trump as a brand manager? He got educated at Wharton, the #2 marketing school in the country according to U.S. News & World Report reports! Through his own individual efforts he’s built one of the great brands in America: Trump.

Trump: The Cause

The only way to make Trump electable was by making his opponent, Hillary Clinton, seem like a worse choice. Trump used his ability and skills as a brand manager to identify susceptible segments of the population and crafted his message to appeal to them.

Specific inactions of Clinton made Trump’s program effective. On September 9, Clinton correctly identified Trump’s strategy when she segmented Trump supporters into two camps: Deplorables and Left-behinds. Instead of making a direct appeal to Left-behinds she then told her supporters that “Those are people we have to understand and empathize with”.

I had thought her segmentation was brilliant but then was puzzled why she did not scoop the Left-behinds up with a targeted uplift campaign.

Left-behinds are a natural consequence of globalization where factories move from country to country chasing lower costs and new demand. While workers lost their livelihood, the benefits accrue to the wealthy. The only way to counter this is by taxing the wealthy beneficiaries to provide the Left-behinds with retraining and other support (childcare, for example) so they can grab a piece of the new economic order.

As Republicans are focused on cutting taxes, this is a program that Democrats should be able to prove is not coming from Republicans and was part of Clinton’s agenda.

Her absolute lack of any emphasis on how her programs would improve the economic welfare of Left-behind voters created a vacuum that Trump filled.

Hillary Clinton’s advisors ignored Bill Clinton’s pleas and failed to realize that Trump was appealing to the same, non-bigoted blue-collar voters who had elected Obama (who is a black man) in 2008 and 2012 and Bill Clinton before him.

Trump started by promising all sorts of improbable growth and change that he claimed would benefit the Left-behinds. Next, he charged her with being a criminal, supported by fact based but negative independent media on her email server and leaked emails. The void was further filled by appealing-to-the-target but obviously false stories of impending arrests and other investigations.

While Trump was portrayed as promising too much and loose with the facts, a minor sin; Clinton was portrayed as a crook.

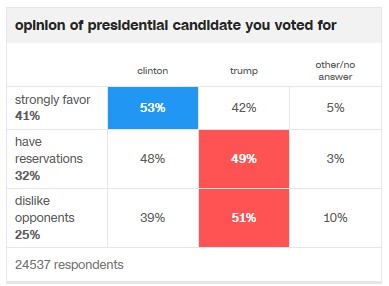

Exit polls confirm that this is the reason why he won. As shown in the chart below, people who strongly favored one candidate over the other picked Clinton, 53% to 42%. Voters who disliked the opponent picked Trump, 51% to 39%.

Even so, Trump’s personal nastiness compared to Clinton’s positive personal image (after all, she’s a Sunday school teaching grandmother) means that dislike of her claimed dishonesty would not normally motivate people to get out the vote.

Getting out the dislike-Clinton vote required something else: Fresh proof of her dishonesty right before the election.

The FBI provided this. FBI director Comey’s October announcement of potentially more damaging Clinton emails triggered a surge in the anti-Clinton vote.

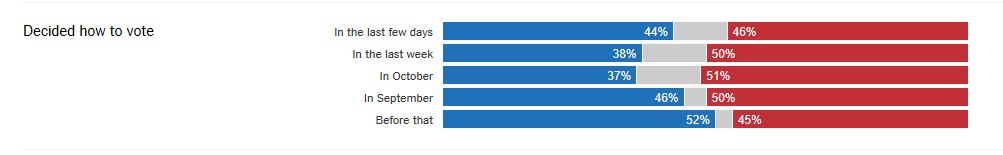

Again, exit polls confirm that Comey’s actions were critical in swaying the vote. The chart below of when actual voters “decided how to vote” shows the breakpoints as Trump’s strategy gained traction. First, there was a dramatic drop in support for Clinton from those who decided before the Deplorables speech (52% for Clinton) to September (46% Clinton). Comey’s October announcement was the death stroke: Clinton support dropped to 37% of deciders. Only in the last few days after Comey declared the investigation had found nothing new did Hillary’s numbers recover to 44%. Note that this increase in the last few days refutes Democratic statements that the 2nd announcement was worse than the original.

The major affect of Comey’s announcement was an increase in turnout of Trump voters that was totally unprecedented and a decrease in Clinton voters that broke all the models.

None of the pollsters correctly read what was happening and none of the pundits who claimed to have seen this increased turnout before the announcement were correct: It only happened because of unpredictable actions by the FBI so they couldn’t have forecast it.

However, there is no excuse for researchers and Clinton strategists to have missed this shift as it occurred. The September shift would have been obvious in every unadjusted poll as it happened. Any decent brand manager would’ve noted and reacted to this trend. Apparently, Clinton had too many researchers and political strategists and not enough marketers who have worked in the real world.

Note: The exit poll above is a shared poll of 24,537 voters sponsored the National Election Pool, a consortium of ABC News, The Associated Press, CBSNews, CNN, Fox News and NBC News.

Trump: The Effect:

Predicting what’s gonna happen under Trump is difficult because some of the things he’s claimed he’s going to do are unlikely to pass his own Republican-controlled Congress. Some things are certain to occur: tax cuts, changes to health care, and certain types of deregulation. Some things are possible but face budget barriers with infrastructure spending being the most likely to be reduced or eliminated.

Before you say I left it out: All that social stuff on the Supreme Court, gay-rights, and abortion: Very unlikely to have an economic effect though they will be a catalyst for the 2018 elections.

My question is will the certainties be economic positives or negatives? Here’s my researched based guesses:

Tax cuts:

- These have the highest likelihood to occur but will have minimal benefit on economic growth due to concentration at the high-end in both Trump’s and Ryan’s plans. (Ryan’s plan is probably going to be enacted as the House decides what tax bills to forward to the Senate.)

- Research shows that tax cuts to the wealthy have very little effect on spending. Only the part of Trump tax cuts that benefit the lower 90% of income groups will have any immediate effect on aggregate economic activity.

- 62% of the Trump tax plan will go to the top 10% of income. The Ryan plan is slightly different but still very concentrated to the rich.

Deficit:

- Tax cuts will increase the deficit which, à la Minsky, increases corporate profits which may have a benefit on the stock market.

- The deficit will not cause any economic stress even if it explodes government debt to well over 100% of GDP. Historically, government debt has gone as high as 240% (Great Britain and Japan) with minimal effect on growth. Remember: All that research on a catastrophic deficit cliff has been debunked due to arithmetic errors.

Inflation fears and growth

- Deficits per se do not increase growth or inflation when at the zero lower bound (ZLB) of interest rates.

- The tiny so far increases in interest rates to approximately what they were last year is not indicative of a move off the ZLB.

- Irrational exuberance may temporarily push interest rates higher but that will probably put them ahead of the inflation curve. This will be a drag on growth

- The Federal Reserve’s almost certain interest rate increase in December 2016 will greatly decrease the likelihood of increased inflation, exactly as it is intended.

- Faster growth will lead to faster increases by the Fed as they try to normalize short term rates, another drag on growth.

- Overall, anticipation of inflation will probably push rates higher than economic activity merits, slowing growth.

Spending/fiscal stimulus:

- While deficits may not cause economic growth, government spending paid for by increased deficits can increase economic activity as Trump is well aware.

- All of the central bank monetary stimulus has primed the pump for fiscal stimulus which the Republican Congress was unwilling to do under a Democratic President – things have changed.

- Unfortunately, increasing deficits from tax cuts will reduce the willingness of House Republicans to increase infrastructure spending.

- Direct infrastructure spending is much more effective than tax cuts at generating growth. It’s in the arithmetic: Tax payers save part of a cut while the government would spend all of it.

- Military spending will also generate growth but less than infrastructure spending – it does not add to the economic base.

- Expect strong growth if a large infrastructure program is passed in Trump’s first 100 days.

Financial deregulation:

- Replacing Dodd-Frank with Glass-Steagall is effectively a deregulation as Glass-Steagall is no longer sufficient to regulate today’s lending markets.

- Eliminating part of Dodd-Frank is probably not going to cause any immediate problems as long as capital requirements remain in place.

- If capital requirements are eliminated, there is a high likelihood of a Minsky moment type crisis as occurred in 2008.

- Because the financial markets are significantly more leverage than they were in 2008, this crisis could occur quicker than most will anticipate – possibly within 2 years.

Environmental deregulation:

- Even if Trump reduces many environmental regulation there is unlikely to be much change due to local activism. The business benefit will be highly specific rather than benefiting broad groups.

- Coal is unlikely to come back because it’s being killed by low natural gas prices which are likely to continue for the next 30 years due to environmentally friendlier fracking.

- Changes in automobile efficiency goals will have minimum effect on industry profitability. It makes life a little easier but they would’ve been able to handle the original goals.

- Small business may benefit as they may be able to compete in areas that had previously been ruled out due to environmental regulations crafted by large players that only they could afford to meet.

Healthcare changes:

- Insurance companies are fighting the elimination of Obamacare because they’re afraid of the combination of being forced to insure people with pre-existing conditions combined with no universal mandate forcing people to buy insurance.

- Essentially, this would put every insurance company out of business as no one would buy insurance until they got sick. People would leave employer plans in droves if there was a viable individual insurance market option.

- House Republicans will be the deciders on what happens to healthcare and they are likely to be much more aggressive than insurance companies would like.

- The current House plan prevents insurance from being refused due to preexisting conditions and does not require universal insurance but has a “penalty” for late enrolment outside of the original signup period.

- It’s difficult to tell but there appear to be 3 possible outcomes from the plan: 1. Greatly increased federal costs or 2. Collapse of the individual market back to pre-Obamacare insured levels or 3. Both. For these reasons, the actual plan will be significantly different than proposed

- Employer plans will still provide the majority of insurance as the individual insurance market will almost certainly collapse if insuring pre-existing conditions is maintained without a universal mandate.

- Overall, foreseeable healthcare changes are negative for hospitals, medical services, and insurance companies (unless, of course, option 1 occurs: greatly increased federal cost.)

- Pharmaceuticals may benefit if attention is taken off of efforts to lower drug prices.

Consumer spending:

- There is a slight possibility that consumer confidence will be negatively impacted by the election of Trump. A recession could occur if the anti-Trump crowd panics and starts increasing savings rates.

- The next few months of consumer confidence and holiday sales data will indicate what’s occurring in this area. Currently this data is positive.

- Investors should follow the monthly Conference Board Consumer Confidence Index and the weekly Bloomberg Consumer Comfort Index for early indications of changes in consumer spending.

International Trade:

- While almost all of Trump’s stated trade policies would have negative effects, it is unlikely that anything truly harmful will be enacted. It’s difficult to change existing treaties quickly.

- The Trans-Pacific Partnership has very marginal, if any, benefits which are offset by possible negatives so it is no loss.

- The Paris Agreement climate change treaty does not go into effect until 2020.

Who will benefit:

- The anticipated tax cuts will benefit the wealthy and will increase concentration of wealth.

- Job growth should increase at least in the short term, potentially increasing wages for the middle class and working poor.

- It is unlikely that Trump will be able to increase the minimum wage as promised but this will benefit the lower income groups if passed.

- Unless Trump develops new programs for rural areas, economic forces will concentrate benefits in the anti-Trump urban areas.

Summary:

- Overall, Trump’s election should result in at least a short-term boost in economic activity, provided he passes expected tax cuts and spending measures in his first 100 days.

- Negatively affected will be insurance and healthcare companies due to changes in healthcare.

- If there is no decrease in consumer confidence (or hopefully an increase) consumer spending should continue to buoy the economy.

- Interest rate increases may choke off the economic expansion if they occur rapidly.

- If financial deregulation of capital requirements is done there will almost certainly be another fiscal crisis, possibly quickly.

- It appears that the Left-behind will continue to be left behind.

The impressive report, Public vs. Private Sector Compensation in Ohio: Public workers make 43 percent more in total compensation than their private sector colleagues (the Report), by 2 highly qualified PhD economists comes to an amazing conclusion. How did this big of a disparity come to exist?

Reading the 1st conclusion in the executive summary raises a red flag:

- actual take-home pay for public employees is 2.5% less than for comparable private workers

Deeper in the Report, actual out of pockets costs for public and private benefits are listed (but not summarized) which are similar to those in a recent study that ranked Ohio Public Employee Retirement System (OPERS) benefits in the middle of the pack of the 15 largest Ohio private employers. Here’s how the out of pocket from each lines up:

|

Out of Pocket Costs – Public Versus Private Retirement % of Salary |

|||

|

The Report Average of all Corporations |

Ohio 15 Largest Private Employers |

OPERS Taxpayer Contribution |

|

| Social Security |

6.2% |

6.2% |

0 |

| Retirement Plans |

6.0% |

7.6% |

14% |

| Total |

12.2% |

13.8% |

14% |

All of the difference in compensation is due to valuations of benefits compared to private employers, not actual out of pocket costs. The Report’s conclusion is not that the costs of Public Employees’ Benefits are that much different than Private Employees but that Public plans deliver much more value for the buck than Private plans.

This Report breaks new ground in trying to calculate the value of public sector retirement benefits compared to private sector benefits. The 43% higher compensation in the title is from two separate calculations: 11.8% for the value of Public employees’ job stability and 31.2% for “fringe benefits”.

Valuing job stability is difficult as there is no actual out-of-pocket cost to tax payers or performance penalty to act as a baseline plus there are serious issues and outdated assumptions in the Report calculations. First, 10 of the 11.8 percentage points are from an assumption that public employees would have to take a job with lower total compensation (wages and benefits) if they went in the private sector even though public employees make less take home pay and the higher benefits are being counted in the 31.2%.

Hmm? Isn’t this an unrealistic “Scrooge” pay plan that counts an imaginary 10% cut as part of your compensation? Never mind, let’s just agree to throw this 10% out as double counting.

Public employees’ greater job security was valued at 1.8% of compensation based on unemployment differentials that the report did not adjust for the “switching” from public to private employment. In any case, there is no premium from public job security today: Government is predicted to continue cutting jobs while the private sector is growing. In October 2011, government shed 24,000 jobs while private employers added 104,000 according to the Bureau of Labor Statistics.

The Report concludes “when pay and benefits are taken into consideration public workers receive 31.2 percent more in total compensation than private sector counterparts%.” There are 2 areas that need to be investigated to figure out if the report is right:

- What is a “private-sector counterpart” and is this comparison correct?

- The report compares public employees to the average for full time employees at medium to large private employers. This appears reasonable.

- The comparison calculates the difference in ““pension compensation” which represents the present value of future employer funded pension benefits accrued in a given year of employment.” The calculations in large part depend on the fact that public employees have defined benefit programs while most private employees have defined contribution programs.

- This difference between defined-benefit programs at private and public employers has mostly arisen since 1980 so this comparison shows how much compensation private employees have lost since 1980 – if the calculations are correct. The Employee Benefit Research Institute (EBRI) has compiled historical retirement plan data, though the early years are slightly different for public and private data. Plan coverage for full time employees at medium to large private employers has declined from 91% in 1985 to 66% in 2010 while public employee retirement plan coverage declined from 98% in 1987 to 94% in 2010. Defined benefit plan coverage for private employers had declined from 84% in 1980 to 30% in 2010 while Public employee coverage by defined benefit plans has only declined from 93% in 1987 to 87% in 2010. This data is summarized in the table below.

| Plan Type |

1980 |

1985 |

1987 |

2010 |

||||

| Private | Public | Private | Public | Private | Public | Private | Public | |

| All retirement |

N/A |

N/A |

91 |

N/A |

N/A |

98 |

66 |

94 |

| Defined benefit |

84 |

N/A |

80 |

N/A |

N/A |

93 |

30 |

87 |

| Defined contribution |

N/A |

N/A |

41 |

N/A |

N/A |

9 |

54 |

19 |

Source: EBRI compilation of the US Department of Labor, Bureau of Labor Statistics data

- Is the calculation that public employee benefits are 31.2% greater value than private benefits correct? If not, what is the true difference?

- The 31.2% is based on using an “ivory tower” riskless rate of return rather than actual, “real world” investment returns to calculate the value of Social Security benefits and future liability for Public retirement plans. The note below goes over the paradox that “risk free” securities are not free of investment risk. As benefits are paid in the real world, real world rates of return are appropriate.

- Social Security benefits and returns are mandated by Congress rather than based on investment returns so there is validity to the fact that Public retirement plans investment returns are better than Social Security. The Report calculated this to be an effective 4.2% reduction in private employee compensation based on the riskless rate of return. The actual difference is greater as Public retirement benefits result from actual rates of investment return. There was a major adjustment down in SS benefits in 1982 (rather than an adjustment upward in returns) to match income and liability so most of this difference is the result of a reduction in benefits to private employees.

- The remaining 27% difference is not valid because it is based adjusting Public plan benefits to reflect an “ivory tower” riskless rate of return rather than a real world actual rate of return on investments. As benefits are paid in the real world and there is no evidence that Public retirement plans to use an incorrect rate of return, there is no basis for increasing public compensation to cover retirement plan shortfalls.

In summary, it appears that the Report reveals that Private employees are similar in total out of pocket benefit costs to Public employees but the value of benefits received is greater for Public employees. The majority of this difference is due to the congressionally mandated lower return on Social Security contributions.

An unanswered question is whether the major shift of private employers from defined benefit to defined contribution retirement programs has resulted in additional reductions in private versus public employee benefits.

* Note on the Report’s calculation of retirement benefit costs.

The question here is whether the “risk free” rate or the rate of anticipated return, as is currently done, should be used as a discount rate for public defined benefit plans.

The comparison is made to private plans which use the more conservative corporate bond rate rather than the estimated return on investment. The reason the rate is specified for corporations is so they cannot manipulate the rate to increase their profits by lowering their required contribution. Public entities don’t have this “profit” motive that is proven to lead to so much abuse. There is no proof that there is a widespread problem with public pension plans using improper rates of return while there are many examples of improperly funded private plans.

The statement in the report that “For these purposes, however, all that matters is that the accounting be made consistent between different pension types” is totally incorrect as the dangers of abuse to each plan are significantly different. Accounting standards are designed to eliminate potential misstatements and abuse. Financial analysis is needed to establish whether there is adequate funding and accounting standards’ requirement of eliminating abuse can and do conflict with getting the best possible financial statements.

Using the “risk-free” rate cannot give a clear picture of the financial status of a retirement plan. First, you need to understand that the “risk-free” rate is not actually free from risk. “Risk-free” securities are free from default risk. Default risk is the risk that the company or country will not be able to pay when the security comes due. Because the U.S. Government prints dollars, the possibility that it will default on its bonds is zero so they are “risk-free”. (Even Congress cannot default on these debts as the 14th amendment states “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.”)

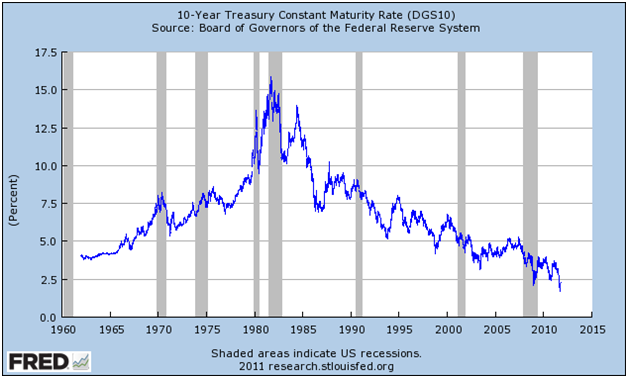

But default risk is very small for any investment grade security – that is why they are “investment” grade. The real risk for any bond is interest rate risk. Even government bonds have interest rate risk; in fact, interest rates changes often make government bonds prices more volatile than the stock market. The chart below shows the “risk-free” rate on the 10 year Treasury bond from 1960 to the present. As you can see rates have varied from over 15% down to the current rates of below 3%, a 5 fold range.

The wide, year to year swings in interest rates has resulted in significant problems with private plan funding which are being partially addressed in proposed international accounting rules. The rate of anticipated return does not have the skew caused by wildly varying interest rates and is preferred on a financial basis when the entities involved are trustworthy. History has shown that governments are much more trustworthy than corporations in financial reporting and accounting standards reflect this. New proposed Government Accounting Standards Board (GASB) rules have affirmed this is appropriate for existing public defined benefit plan assets with discussions purely focused on how to report funding shortfalls.

Finally, there’s no proof that Ohio pension plans are significantly underfunded on a long-term basis as alleged in the Report. The cited Congressional Budget Office report, “The Underfunding of State and Local Pension Plans” (May 2011), looked at the funding gap that occurred in 2008 and 2009 during the depths of the recent recession when asset prices were depressed. Since that time there has been a recovery in asset prices that has closed most if not all of the gap.

In sales, there is a technique to make buyers decide to purchase called the “Ben Franklin Close”. It is a simple two column list with all the reasons to buy on one side and all the reasons not to on the other. The side with the greatest number of reasons shows which decision to make.

A broad stroke look like this of where the market is likely to go is useful if you are a mutual fund investor whose investments generally follow the whole market, or someone who’s willing to invest in inverse funds to benefit from downside moves. My list on whether to buy or sell the current market is shown below:

|

Reasons S&P500 will Go UP (BUY) |

Reasons S&P500 will Go DOWN (SELL) |

|

1. The market is still down 42% from its highs |

1. The market is up 25% from its lows. |

|

2. There is a lot of cash on the sidelines |

2. Market volume is moderate, at best. |

|

3. There are signs of improvement in the economy |

3. The economy decline was worse than anticipated in the first quarter, which could get even worse as initial reports are revised. |

|

4. The government has undertaken unprecedented monetary stimulus. |

4. Corporate earnings are forecast to decline until the 4th quarter (Standard & Poor’s) |

|

5. The government has some fiscal stimulus starting to kick in. |

5. Standard & Poor’s estimates that the S&P 500 will have a negative price/earnings (P/E) ratio in the third quarter of 2009 |

|

6. There has been some improvement in consumer confidence surveys and reported spending |

6. Dividends are declining (S&P500 first-quarter 2009 dividends $5.96, down from $7.15 in fourth quarter 2008) |

|

|

7. P/E ratios never hit the historic bottom. Currently S&P500 is about 15. The high historic bottom is 8 and the recent market bottomed at 12. (Based on 10 year averages as calculated by Robert Shiller) |

|

|

8. Housing prices continue to decline and could reach the levels of 2002 if the Japan experience is duplicated. |

|

|

9. The initial stress test shows that banks are still undercapitalized so lending will continue to be weak. |

If you have more reasons the market will go up, please add them in the comments. There are more reasons to put onto the down side but the list is already too depressing.

If you’re cautious, then the best thing is to be out of the market. If you’re aggressive than there seems to be more downside from here than there is upside and inverse funds are an opportunity for you.

If you’re a stock picker there are plenty of value stocks to pick from today though I’m personally waiting for the next leg down to buy.

Credit Default Swaps (CDS) are going to wipe out most companies that wrote them due to the cascading effects of a default. Any company that has CDS expose will never be a good speculative investment.

A Credit Default Swap is basically an unregulated insurance policy that any company can write on any financial instrument that someone else wants to reduce their risk on. During the financial boom times (up until early 2008) banks, hedge funds and other companies would sell CDS’s and then buy a CDS on the same security to offset their risk and make money on the spread. This multiple sell/buy is why CDS notional value is $54 Trillion, about 2 times the USA GDP.

A default on a security that a CDS is written on has a geyser like effect: The default flows like water from the security holder to their CDS writer, who passes it on to their writer who does the same. Ultimately, it comes to a CDS that is naked (without CDS or other reinsurance) and the writer has to pay up. As most of these companies were leverage 30 to 1, it is unlikely that they will be able to pay. Just like water that hits the hot bottom of a geyser, this claim shoots back up the system until it finds a financial entity that can pay up. Add enough defaults together and you get something with the predictability of “Old Faithful” that will blow up all the writers which includes many of our major banks.

A CDS default forces banks and other writers to put out more money. In Japan during the 90’s banks were insolvent because the securities behind loans had gone bad and the government simply put off having banks recognize the loss until they could do so without going bankrupt. With CDS’s, writers will need additional capital – banks will get it from the Government but hedge funds, etc. will go bust.

The system will remain frozen due to fears that the deepening recession will cause CDS defaults to happen. Establishing a clearing house for derivatives may not help as it may force an immediate recognition of the liability of CDS’s by banks. Not establishing a derivative market/clearing house is probably worse as the system can’t clear itself without a fair and open market.

Looks like all roads lead to bank nationalization: Do something and it will force recognition that banks are undercapitalized (York University Professor Nouriel Roubini estimate the gap at $2.2 trillion.) Don’t do anything and bank will be forced to keep asking for money as CDS’s are claimed – a lot of money that will ultimately result in the Government owning most of them even if it doesn’t want to.

Just 3 days into the new administration (Friday Jan 23, 2009) gold is up $40 or so to $897 per oz. The most interesting thing about this rise is the surprise among gold bugs that the Commitment of Traders report shows the bullion banks reversing their previous position and going long.

Gold Bugs: Wake up. Everybody should know by now that the New Guys are Keynesians and love a lot of what FDR did. This means they will do everything they can to stop deflation and one thing they will almost certainly copy is FDR’s devaluing of the dollar against gold as an anti-deflation device. FDR moved the dollar from $20 to $35 per oz, a 75% devaluation, so if the New Guys just copycat this pattern gold will go above $1600 per oz fairly quickly.

Many people state that the New Guys will not devalue gold right away because first they will have to make it illegal for US citizens to own gold like FDR did. FDR had to get gold out of use as currency before he devalued it which is why he outlawed ownership. This is not needed today as we don’t use gold coins or scrip.

One more reason that the New Guys will devalue gold: physical gold owned by citizens is a plus because increasing the value of gold will offset some of the other asset value declines in stocks and housing.

As this is purely a manipulation, I bet that gold will not go above the old inflation adjusted high of $2000.

Yesterday I was told that 42% of people did not pay taxes. I commented back that everybody paid at least 15.3% because of Social Security (FICA) and Medicare Taxes. These are just another tax because they are not placed in a dedicated pool and are used to reduce the deficit. I count the employer contribution as a tax on wage earners as they could be given to the wage earner if not sent to the government.

This raised the question of who paid the most tax if SS and medicare were counted in. The taxes stop at $102000 of income so lets compare that marginal tax rate to that of a $1 million earner. Using a tax calculator for the income tax shows that the $102,000 wage earner pays an average of 34.9% and an incremental rate of 43.3% in total taxes versus an average of 34.1% and an incremental rate of 35% for the $1 million earner as detailed below:

| Wages |

Average Tax Paid |

Tax Bracket |

Marginal Rate |

| $102,000 |

|

|

|

| Income Tax |

19.6% |

28.0% |

28.0% |

| SS and Medicare |

15.3% |

15.3% |

15.3% |

| Total Taxes |

34.9% |

43.3% |

43.3% |

| $1,000,000 |

|

|

|

| Income Tax |

32.6% |

35.0% |

35.0% |

| SS and Medicare |

1.5% |

0.0% |

0.0% |

| Total Taxes |

34.1% |

35.0% |

35.0% |

This is the 2nd of a 3 part series on:

1. How the current economic crisis occurred,

2. What needs to be done to fix it and

3. Tracking how successful the government is in taking the needed steps

“Eyes Wide Shut” Economic Plans won’t stop the Greater Depression

My businessman’s mind is amazed by the lack of fact based, goal oriented solutions from our political leaders for the current economic crisis.

What’s been done so far to fix the economy duplicates the efforts of Hoover as the economy spiraled downward from 1929 to 1932 and it is easy to project that if this keeps up we are heading to the “Greater Depression.” In the calendar of the Great Depression, today (January, 2009) is January, 1931 and the worst is yet to come – in 1932 GNP fell 13.4%.

Secretary of the Treasury Paulson has failed to prevent the crisis because he tried to save the stockholders in current banks and investment firms (just like Hoover) and did not implement the regulatory structure needed to rebuild confidence in our market system. Banks are toast because of huge exposure in unregulated derivatives (Credit Default Swaps, just one type of unregulated derivative are $54 trillion, that is 12 zero’s, compared to a bank capital base in the billions.) As soon as a regulated market is established for these derivatives, banks that hold them will go bust and need direct investment from the government that will wipe out stockholders. If we do it quickly we might avoid the “Greater Depression.”

Many politicians are standing in the way of any program that does not contain at least a dash of their political ideology. Republicans seem to accept any stimulus program as long as it involves tax cuts even though the last 8 years have proved these are unaffordable (tax cuts only give, at best, 50 cents on the dollar of stimulus.) Democrats are pushing for jobs programs, infrastructure building, welfare extensions and some consumer mortgage relief that seem to mostly be the things that didn’t work for Japan during the 90’s and start to raise “welfare society” issues.

All of the current solutions seem to be based on what politicians think are politically salable to their base. The people are not fooled: The Conference Board Consumer Confidence Index™ reached a new all-time low in December 2008 of 38.0 (1985=100).

What we need is economic leadership that will recognizes what is actually happening, kind of like Petraeus did when he used a different “hearts and minds” strategy to make the surge work in Iraq. (Note: Petraeus led the 2nd surge in Iraq – the first, with equal troop strength but using conventional tactics and strategies that ignored the realities on the ground, didn’t work.)

We’ve seen the type of leadership we need: FDR gave the leadership the USA needed in the Great Depression when he stated that “all we have to fear is fear itself” to calm public fears that were causing runs on banks and subsequent bank failures. He combined this with a bank holiday (during which banks were suppose to be inspected for fiscal soundness, an impossible task) so he could implement FDIC insurance and give banks the stability needed to start lending again.

Three areas need to be addressed to solve this crisis (see my previous post for reasons why.) These can be considered the nation’s objectives:

1. Stop Deflation

2. End the Banking Crisis and Restart Lending

3. Rebuild Consumer Confidence to restart spending

There are a lot of ways to achieve these objectives and later blogs will track the government’s success. Here’s just a few ideas:

Stopping Deflation – The primary cause of deflation was the decline in housing prices. Stock market declines have happened in the past and not led to deflation so they are not the cause of the current deflation. Below are 2 different tracks that can be taken to reverse deflationary pressures, one that is obvious and another that is less so:

1. Demand and supply adjustments for housing:

o Reduce foreclosures/defaults to reduce the supply of homes for sale

§ Government Bailout of mortgages that are above current home values. Rational homeowners should abandon houses where the mortgage is greater than the home value. By bailing out homeowners with negative equity, bank balance sheet would be strengthened and the amount of distressed homes coming on the market would be reduced.

o Government purchase and demolition of substandard housing. The government should make an active program of purchasing distressed houses and demolishing those that are substandard. A sub program could be the refurbishing of better houses for subsequent auction or low-cost housing usage. These will increase employment as well.

o Reduce mortgage rates. Reducing mortgage rate will increase the number of potential buyers but may not be effective if the perception is that housing will continue to decline.

2. Devalue the dollar by increasing the price of gold.

· This was one tactic FDR used to stop deflation during the Great Depression. Devaluing the dollar against other currencies is what should be done but it is impossible because of manipulation by foreign governments. Gold is a currency equivalent so an obvious rise in gold would mean that the dollar is declining and deflation has stopped. What is great about gold is a psychological inflation indicator that is disconnected from the real economy: inflation in gold will not cause inflation in anything expect jewelry.

· Note: Paulson’s Treasury appears to be continuing inflation control efforts that are keeping the price of gold it down!! Simply removing the manipulation would probably allow a sufficient rise in the price of gold to reduced deflation expectations.

Ending the Banking Crisis and Restarting Lending-The banking crisis was caused by excessive leverage and poor regulations that allowed investment in unsafe assets such as collateralized mortgage obligations (CMO’) and resulted in reduced lending as bank’s capital bases were vaporized. Some solutions are:

· Emergency legislation forcing bank lending-this can include government supplements on real estate and some business loans so that banks can be compensated for the greater risk of lending during a fiscal crisis. This is necessary as we are currently in a “Liquidity Trap” where normal lower interest rate stimulus won’t work.

· Establish regulated markets for all derivatives. This is today’s equivalent of FDIC insurance. Establishment of fair markets will eliminate fiscal instability but probably result in many Credit Default Swaps being worthless causing the bankruptcy of more investment firms and banks necessitating:

· Rebuilding of bank capital bases with direct government equity investments. The plan should include a requirement for the government to sell their equity ownerships once banks were stable.

Rebuild Consumer Confidence to Restart Spending: Nothing lets people spend today than the feeling that they don’t have to worry about tomorrow. Today, all they have is worries. They don’t really worry about the economy per se, it’s jobs and financial security concerns that are at record highs. Here’s some potential fixes:

· Jobs – are purely a matter of spending in the economy. If consumers don’t spend enough to keep everybody working then the government can step in and spend without causing inflation, as long as it is on productive infrastructure and it is done while the crisis is still occurring. Milton Friedman proved that most government stimulus doesn’t work because the crisis is over by the time it kicks in, so no tax cuts as they work really slowly, if at all. Pick the wrong stimulus or do it too late, of course, and here comes inflation.

· Financial Security– In China, where there is no social safety net, savings is a 30% of income and the government is trying everything it can to try to get them to spend more to offset the decline in export to the USA. In America, consumers have started saving and paying off debt at an amazing rate due to rapid declines in their wealth that started with the housing and stock market declines and was brought into focus by the gas price spike. Before they start participating in our debt, consumers need to secure about:

o Paying for Gas/transportation: Gas prices doubled in 3 months and are the reason that other retail spending plunged. A stable long term transportation solution is needed.

o Educating their kids: College is necessary for kids to have a better future than their parents and the price has gone 247% in the last 20 years, making it almost un affordable.

o Paying for Healthcare: Illness and healthcare expenses are involved in half of all bankruptcies.

Next in this series will be evaluation of economic plans of the US government and their actual effectiveness in solving the crisis.

This is the first of a 3 part series on:

1. How the current economic crisis occurred,

2. What needs to be done to fix it and

3. Tracking how successful the government is in taking the needed steps

How the Economy Failed Again or “Dragons We Know”

2 recent NY Times articles show the blindness that led to the failure of today’s economy. First, the No Instruction Manual as Stimulus Bill Takes Shape article stated that we don’t know how to develop a plan to solve the current crisis, ignoring the lessons of the fight against the Great Depression. Second, Risk Mismanagement showed how “quants” (the wiz kids who did the mathematical investment models that failed so spectacularly) underestimated the risk of low probability events. One quant labeled the 1% probability tail as TBD, not standing for “to be determined” but rather “There be Dragons.” This is a great analogy because not only does it illustrate that low probability events can kill the unwary but also that the really dangerous ones are identifiable. Just like St. George, if you fight dragons you might survive and prosper but you will eventually be destroyed if you ignore the potential dragons.

So what did we forget that caused the current financial crisis? The primary cause is the deliberate avoidance of looking for “dragons” (potential problems) that resulted from the revival of Laissez-faire economics (called variously Austrian, Supply Side, or classical economics). Laissez-faire advocates state that free markets will regulate themselves; therefore, there is no need to look for problems. In fact, Dick Cheney stated that “I don’t think anyone saw it coming”. Actually, problems were easy to see coming due to historic highs in stock Price to Earnings (P/E) and housing rent-to-own ratios. Amazingly accurate predictions were made by many widely read individuals (such as Bill Fleckenstein, Doug Casey or Nobel laureate/NY Times columnist Paul Krugman).

Historically, the idea that free or unregulated markets will have any sort of acceptable performance has been proven wrong by the Panics of 1873, 1884, 1890, 1893, 1896, 1907, and the Great Depression, among others. Besides, the concept of self regulating markets does not fit with human experience:

If it takes 3 to 5 referees to regulate 22 people in a game of football (depending on which continent you are on) why would business people who are playing for real money not need supervision to prevent cheating? (See End Notes 1 and 2 below)

The current crisis is almost identical with the Great Depression:

National Deflation in overvalued assets (housing and stocks) leading to:

?

Banking Crisis that reduces lending and financial liquidity which causes a:

?

Consumption Recession (as opposed to a business cycle recession where business activity slows first) where:

· Excessive consumer debt limits most consumers’ ability to borrow for current purchases and

· Affluent consumers reduce consumption as they increase savings or pay off debt.

The causes are also similar (which is why so many people could predict it):

1. National Deflation – is the result of asset bubbles caused by unregulated debt expansion outside on the regulated banking and investment areas.

· While all of banking had minimal regulation in the 20’s, today’s loose housing lending started around 2002 when

· A new government program to help low income people get houses with no down payment

· Intersected with new unregulated derivatives.

The derivatives market allowed banks to lend to high risk borrowers and make money by selling (securitizing) these high default rate loans to investors. Loosening of government regulation of Fannie Mae and Freddie Mac in 2005 accelerated the search for bad loans to securitize. Rising housing prices and easy money brought in speculators which pushed prices above what wage earners could afford (a bubble.) Prices declined once housing became unaffordable, bankrupting zero down payment speculators and starting the deflationary spiral.

· Both the 1920’s and today’s stock market bubbles were caused by excessive and/or unregulated leverage (a form of lending) at hedge fund equivalents and investment banks which drove stocks to historic high P/E values (a bubble.) Once housing started to decline and the economy slowed as a result, prices had to come down to match declining corporate profits. The profit declines caused P/E declines so the decline in the stock market accelerated.

2. Banking crisis – Deflation in asset values (housing, stocks and commercial bonds) caused some banks to become insolvent and lowered trust in all banks. Runs by consumer depositors on banks during the Depression have been eliminated by FDIC insurance. Today, banks are reluctant to lend to other banks due to uncertainty of their financial health causing more bank failures. The ongoing deflation in asset values causes a Liquidity Trap, reducing all lending.

· A Liquidity Trap occurs when banks expect better returns by holding money instead of making loans. Declining real estate, securities values and corporate profits and rising unemployment make banks tighten lending standards to the point that few consumers or businesses can qualify, thereby drying up the funds or “liquidity” that makes the economy work. Normally, the central bank can increase liquidity by lowering interest rates but the expectation of deflation means that banks expect negative returns on loans so even a interest rate of zero (like today) won’t make them lend – In a Liquidity Trap banks won’t lend until convinced that deflation will stop (that is, inflation starts) or they can pay back less than they borrow to make the loan (termed negative interest rates .)

3. Consumption Recession – was caused by the failure of median income to keep up with consumption opportunities (as shown by GDP growth.) In order to take advantage of consumption opportunities, consumers took on more debt with the aid of banks and retailers/manufacturers (GMAC, for example.) This is what happens instead of Say’s Law2 when production exceeds consumption capability in a modern debt generating environment.

· Middle and lower class income growth stalled out in 1982 when the upper income tax rates were brought down from 50% to levels last seen right before the Great Depression. With the tax disincentives on excessive compensation removed, executive pay and other compensation soared from 35 times the average workers income in 1978 to 262 times in 2005, a repeat of the Great Depression play book. In the words of Marriner S. Eccles, FDR’s Fed Chairman, “had there been less savings by business and the higher-income groups and more income in the lower groups — we should have had far greater stability in our economy”

· The decline is made worse by declines in consumer confidence to historic lows, which causes more affluent consumers (those with sufficient income and assets to be able to continue spending at previous levels) to reduce consumption in reaction to a world where economic opportunities are reduced.

The solutions to these problems are fairly cut and dried, having been worked out after the Great Depression. For those doubters:

Why didn’t the US economy experience another liquidity trap until the dismantling the checks and balances put in place in the 30’s was completed by the Bush Administration?

Read my next post to see what needs to be done.

End Notes:

1. Laissez-faire economists counter that markets are self correcting if governments don’t interfere and need the “creative destruction” that comes from corrections to grow. Unfortunately, modern markets (where information is quickly distributed) are not self correcting as proved by The Great Depression and Japan’s stagnant economy in the 1990’s. Lots of reasons why today’s markets can’t self correct without government help but it’s irrelevant because democracies are for the people and the people have spoken: The “creative destruction” of the unregulated Panics of the 19th and early 20th Century caused unacceptable hardships therefore there is going to be government intervention and regulation to try to smooth them out. Live with it and make sure government intervention works.

2. As a business man, I find it fascinating that Laissez-faire economics depends on an 18th century theory called Say’s Law that essentially states that “if you build it they will buy it.” No way this works in a market based economy with rapid technology change and environmental laws. In the 18th century, any manufactured product had some utility, if only for scrap so inventories could be cleared by market pricing action. Nowadays, you can build the wrong thing and it can not only be unsalable but also be toxic waste that costs money to get rid of, becoming a burden on the government when the manufacturer goes bust.

This is the first post for the One Eyed Guide© and what could be more fun than trying to answer the number 1 economic question: What’s Happening and will Obama be able to fix it in his allotted 4/8 years?

According to many Gold Bugs, we are headed to the “Greater Depression” and prudent investors should buy physical gold, guns and build a bunker as the entire global economy is about to collapse.

One Eyed Guidance: Bunkering is probably not a good idea as it just makes you visible to the survivors. Besides, who wants to live in a bunker?

The truth is probably different because:

1. Markets (even with government interference) are self correcting so the end result of what is going on now should give a better growth opportunities for most people than what we had before. After all, most people did not have significant real income growth in the last 20 years.

2. The Government has a playbook on how to fix the current crisis. All the current economic problems started around 1982 when a concerted effort was made to dismantling the controls and transparency put in place by our grandparents to prevent a reoccurrence of the Great Depression. Granny and Pappy were pretty smart and when their 1930’s regulations were eliminated and not replaced by new ones designed to handle modern issues…well, here we are in 2008 -Post to follow (PTF) on this. There was a lot of experimentation in the 1930’s and a few things clearly worked and should be implemented by the new administration:

1. Transparent markets, companies and government actions

2. Level playing field regulations ( a.k.a. fair markets in commodities and other areas)

3. Stable financial markets (1 & 2 above plus significant insurance for depositors/investors against financial company failures -$250K does not cut it.)

4. Social Safety nets to encourage consumer spending (healthcare is today’s issue)

5. Stimulate like crazy (lots of ways to do this with housing and infrastructure)

6. Don’t worry about balancing the budget until excess capacity has been pulled out of the system and consumer psychology on the economy is positive (Yes, we will be in a pure Keynesian environment in 2009.)

3. Currently, Secretary of The Treasury Paulson has made things worse as he seems to be channeling Hoover and is making the same mistakes that Hoover did (see Rothbard’s book America’s Great Depression for a description of what Hoover did wrong – just don’t necessarily believe Rothbard’s solutions.) For such a bright man it’s amazing: if the markets need reassurance that financial institutions are stable, why wouldn’t you publicize exactly how the government is supporting them to eliminate any questions?

In any case, he’s gone on January 20, 2009 and we will assume for forecasting purposes that Obama administration will do what they say which is more or less what’s outlined above.

Here’s what this means for your personal investments:

One Eyed Guidance:

-

2009 will be a good time to do long term investments in almost anything. However, holding periods, particularly for value stocks, will be 5 to 10 years and market swings will give a worrisome, rough ride.

-

Speculative investments will primarily be items that will react to government action. Things like gold, gold stocks, corporate bonds and commodities that are good investments in early 2009 will require exiting some time before 2016, possibly as early as late 2009.

-

US Government Bonds of all types will be a terrible long term investment due to the need for interest rates to adjust to reflect actual cost of money. Many groups who are buying them right now will head for the exit as once when interest rates start up and the exit will be jammed, spiking rates.

-

International investment in China should not be done until after the potential for a political meltdown due to slow growth has been resolved.

So, the forecast for the next 8 years that this is based on, with some minimal justification (posts will follow with supporting details) and assuming aggressive government stimulus, is :

By the end of 2016:

· Everybody will have had a rough ride having dealt with slow job growth, deficits, inflation, and general worry about would the government get it right. This assumes they more or less do. As the 2009 economy mostly required spending like crazy for 3 years they probably will.

· Inflation will have been controlled after some ups and downs as the money that was created to solve the financial crisis is pulled back. There is no long term negative from the massive infusion of cash into credit markets due to the much greater destruction of wealth from P/E and asset (mostly housing) deflation.

· Stock Markets will not have recovered to the highs of 2000/2007 due to P/E deflation to historical levels of 12 to 15 on the S&P 500.

· GDP Growth will have recovered to levels from before the 80’s (80’s to 2008 growth was below historical average due to underinvestment in infrastructure) as the effects of infrastructure building kick in.

· Unemployment will still be high by historic standards due to continued job turnover caused by rapid technological change from infrastructure building.

· Housing prices will have recovered to be in parity with costs of construction in most markets. In most markets this will be an increase from 2008 levels

· “Peak oil” will be decreasing the availability of crude but prices will be stable as gas usage declines due to increased efficiency of vehicles and limited expansion of alternative fuel vehicles (either Natural Gas or Fuel Cells unless technical battery problems are solved.)

· The dollar will trade at roughly current levels versus the Euro, and down versus most Asian currencies as long term trade imbalances are corrected.

By Year assuming normal historical cycles (projections get less detailed the further out they are as only the broadest trends can be projected past 3 years):

2009

· The economy will start to recover in the third quarter as the effect of stimulus spending on infrastructure projects in the summer start to spread through the economy.

· Housing price declines will have stopped by this time but sales are weak.

· Markets will be flat to declining to at least mid-year due to declining corporate profits and continued P/E deflation. Lows for the year should occur in the third quarter.

· The credit crisis should significantly ease shortly after January when the new administration takes a large bat to banks and forces them to lend, at least to historical levels. One Eyed Note: It’s unknown which bat the government will use but they have a variety. You’ll know it is working when rates drop and banks start to complain about government interference. Banks that don’t take money from the Fed can complain but there are few of these.

· Consumer spending will have rebounded significantly as confidence has increased, gas prices remain low so non-energy spending can be done and extended food stamp, unemployment and Mortgage relief programs allow more discretionary spending.

· Business spending will be a drag on the economy until the end of the year due to over cautious management.

· The dollar will decline against most Asian currencies except Japan yen.

· The Trade Deficit will decline.

· The Fed starts to unwind monetary stimulus in the 4th quarter.

· Republicans and some Democrats start to talk about balancing the budget.

2010

· The economy will start to grow and jobless rate will start to decline by end of year.

· Stock Markets will start to recover, however the best time to buy will have been before October 2009.

· The economy will declared officially be out of recession during this year with the date probably in late 2009.

· Stronger talk will be heard on balancing the budget and a tax increase on high earners will be passed. Much discuss will be done about avoiding repeating the Recession of 1937.

2011

· The economy will strengthen as will efforts to balance the budget.

· Broader tax increase will be passed to be effective in 2012

2012

· The economy will peak just before the election as the effects of budget balancing start to slow down the economy.

· Inflation will start again as shortages in raw materials occur due to increased demand and greatly decreased short term capacity.

2013

· The economy will significantly slow down; though probably not reach recession levels.

· Inflation will spike and decline.

2014, 2015

· The economy will gradually improve and deficits will decline.

2016

· The economy will peak shortly before the election and be declining on Election Day.

That’s what should happen if Obama does most things right – it’s pretty good but most “conservative” recommendations will derail this. Hopefully, politicians will heed the lessons of the Great Depression.

Get Ready for a Rough Ride and Good Luck for the New Year!