There has been a lot of discussion (or hot air, depending on your opinions) generated on whether deficit stimulus spending helps or hurts the economy in the long run. Keynesians are pretty straight forward in their support of deficit investment as the fastest way out while many conservatives support only Monetary Policy as the better alternative.

There is support for both ideas but recently I received a statement by Van Hoisington and Dr. Lacy Hunt that seemed to be contrary to the historical record that it quotes: “the historical record indicates that massive increases in government debt will weaken the private economy, thereby hindering rather than speeding an economic recovery.“ If it was true, it would certainly indicate that deficit stimulus spending was bad. However, it could only be true if deficit spending lowers the growth rate because the United States, as a capitalistic country, has private ownership of the means of production. Any GDP growth benefits the private economy.

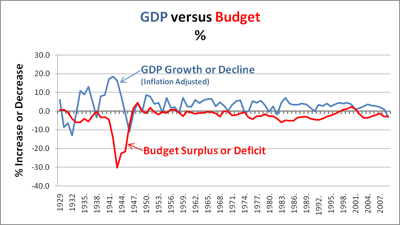

To check this, I did the simple chart below showing the Budget Surplus or Deficit for the USA from 1929 to present versus GDP Growth (Inflation Adjusted) using Census data. The upwardly distorted mirror image on the chart over an 80 year period makes it clear that in the USA increases in deficit have usually resulted in leveraged increases in growth. (It has to be this causation because GDP Growth increases tax revenues so Growth could not increase the Deficit.) How this can be interpreted as weakening the private economy is beyond my comprehension and it certainly does not show any “hindering” of recovery. Perhaps they used foreign data not applicable to the USA?

Note that after 1972 the leverage relation… weakened, probably due to more reliance on tax cuts instead of direct investment when we were already running a deficit. There was an even bigger disconnect in deficit effectiveness in 2004, possibly indicating that tax cuts when the USA is running deficits actually have a negative effect, probably because people save most (or pay down debt) recognizing that they will just have to pay the tax cut back in the future. The Dr. Romer’s, in their paper The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks, showed that an increase in taxes designed to reduce an inherited deficit had a positive effect on GDP growth (1993, for example) so perhaps the opposite is also true.

Based on this information, it’s pretty clear that Keynesians are correct that deficit stimulus investment can speed economic recovery without long term negatives. The question that remains open is whether tax cuts help or hinder recovery when we are running a deficit. The answer has significant policy implications as further tax cuts may just make the current crisis worse while tax increases could speed the recovery.