Dear Mom,

You’ve taught me the value of trusting in others and hoping for the best and I’ve been very successful as a result. Now is the time for me to show you how I’ve learned to apply what you taught me.

I’ve learned that people who make money with other people’s money won’t necessarily tell you everything you need to know when it is your money. For example, that mutual fund representative who told you that now was a good time to invest in the stock market didn’t tell you that the market hadn’t reached a historical valuation bottom. When he said that it might go lower, he didn’t mention that it had always gone lower from the market levels on Mother’s Day 2009 after a speculative top like in 2000.

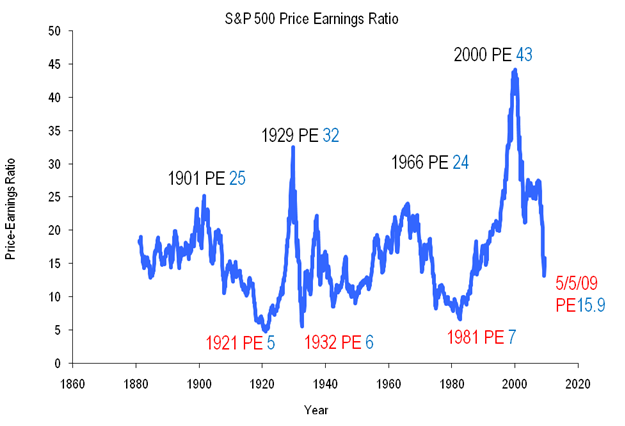

I’ve learned that you should listen to people who don’t get paid if you invest. People like Robert Shiller who wrote Irrational Exuberance explaining the market cycles. Professor Shiller keeps the Price Earnings valuation chart from his book updated on the internet for anyone to look at for free at http://www.irrationale… (this uses 10 year average earnings to smooth out variations.) The chart below shows that the S&P 500 stocks have not hit the historical bottoms like they did after the peaks in 1901, 1929 and 1966. On May 5, the S&P 500 was more than twice as high as the historical bottom so you could lose one half your investments if you invest today.

I’ve learned that the internet has made it easier to find data you can trust. Standard & Poor’s calculates the S&P 500 stock market index and puts the data and future earnings estimates online at www2.standardandpoors….SP500EPSEST.XLS. Currently, the last 12 months reported earnings have a PE of 119. Standard & Poor’s does not project the PE ratios to improve until after the 3rd quarter 2009.

Finally, I’ve learned that our government officials don’t have the courage to control things that are obviously going wrong. When Alan Greenspan was Chairman of the Federal Reserve he had access to the same charts that you do so he could see that the stock market was at historic highs yet he didn’t even try to talk down the market. Now, we have banks that are not lending because they are broke yet our current Treasury Secretary and Federal Reserve Chairman are not taking the actions needed to quickly fix these problems. Maybe their plan will work eventually but history states it will take years, maybe more years than you have left.

A retired widow like you should wait until after the market bottoms to risk any money in the market. In fact, the best Mother’s Day Gift I can give you is to convince you to sell all your stocks after the recent rally.

Your Son,

The One Eyed Guide

S&P500 PE History